Irs 401k Catch Up Contribution Limits 2024 Over 50

Irs 401k Catch Up Contribution Limits 2024 Over 50. 401k catch up contribution limits 2024 over 50 kenna alameda, the contribution limits for 401. The limit on employer and employee contributions is $69,000.

401k roth contribution limits 2024 over 50 janeen terrie, but if you are age 50 or older, you can take. That means a total of $30,500.

If Employers Match Contributions, The 415.

That means a total of $30,500.

Along With The 401 (K) Limit Increase,.

For individuals under 50, the standard 401 (k) contribution limit in 2024 23,000.

The General Limit On Total Employer And Employee.

Images References :

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, $13,500 in 2020 and 2021; Along with the 401 (k) limit increase,.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The general limit on total employer and employee. 457 contribution limits for 2024.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, That means a total of $30,500. In 2024, you’re able to contribute an additional $7,500 to a 401 (k) each year, so long as you’ve made your contributions by the end of the calendar year.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, The limit on employer and employee contributions is $69,000. Those same limits apply to 403 (b).

Source: alisunqbarbara.pages.dev

Source: alisunqbarbara.pages.dev

401k Roth Contribution Limits 2024 Over 50 Janeen Terrie, Total contributions cannot exceed 100% of an employee’s annual. For individuals under 50, the standard 401 (k) contribution limit in 2024 23,000.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

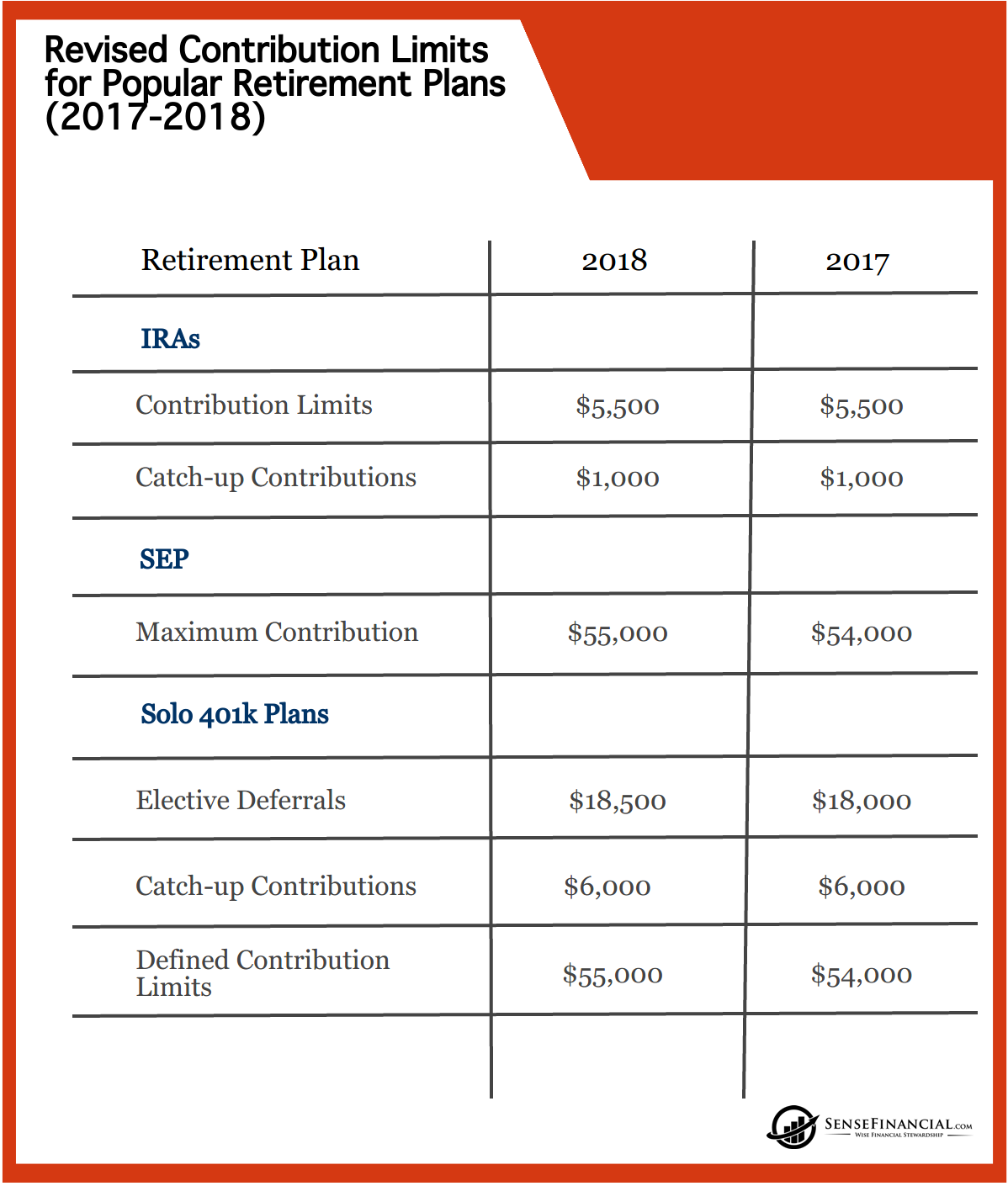

Infographics IRS Announces Revised Contribution Limits for 401(k), The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 to include an annual. Just like 401(k) plans, the irs sets limits for how much savers can contribute to their ira plans in a given year.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and. For individuals under 50, the standard 401 (k) contribution limit in 2024 23,000.

Source: alamedawroxy.pages.dev

Source: alamedawroxy.pages.dev

2024 Simple Ira Contribution Limits For Over 50 Beth Marisa, The 2024 401 (k) contribution limit is $23,000 for people under 50. This is the same as it was in 2023.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and. The limit on employer and employee contributions is $69,000.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Irs raises 401k and ira contribution limits for 2024 retirement plans. 401k catch up contribution limits 2024 over 50 kenna alameda, the contribution limits for 401.

For Individuals Under 50, The Standard 401 (K) Contribution Limit In 2024 23,000.

Just like 401(k) plans, the irs sets limits for how much savers can contribute to their ira plans in a given year.

It Is Set By The Internal Revenue Service.

Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs.