2024 Social Security Tax Withholding

2024 Social Security Tax Withholding. What is the social security withholding rate for employees in 2024? The maximum amount of social security tax an employee will have withheld from their paycheck in 2024 is $10,453.20 ($168,600 x 6.2%).

Up to 50% of your social security benefits are taxable if: This amount is also commonly referred to as the taxable maximum.

What Is The Social Security Withholding Rate For Employees In 2024?

We call this annual limit the contribution and benefit base.

The Social Security Withholding Rate Is 6.2% For Employees In 2024.

Your employer also pays 6.2% on any taxable wages.

2024 Social Security Tax Withholding Images References :

Source: mornaqnorrie.pages.dev

Source: mornaqnorrie.pages.dev

Social Security Withholding 2024 Binny Cheslie, Calculate the estimated payroll taxes due on wages for both employees and employers. The social security tax rate for employees and.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Max Social Security Tax 2024 Withholding Table Reyna Clemmie, The 2024 limit is $168,600, up from $160,200 in 2023. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Source: suzannwcory.pages.dev

Source: suzannwcory.pages.dev

How Much Is Social Security Withholding 2024 Codee Devonna, Calculate the estimated payroll taxes due on wages for both employees and employers. Your employer also pays 6.2% on any taxable wages.

Source: www.youtube.com

Source: www.youtube.com

How To Withhold Taxes On Social Security Benefits YouTube, For earnings in 2024, this base is $168,600. If you are already receiving benefits or if you want to change or stop your.

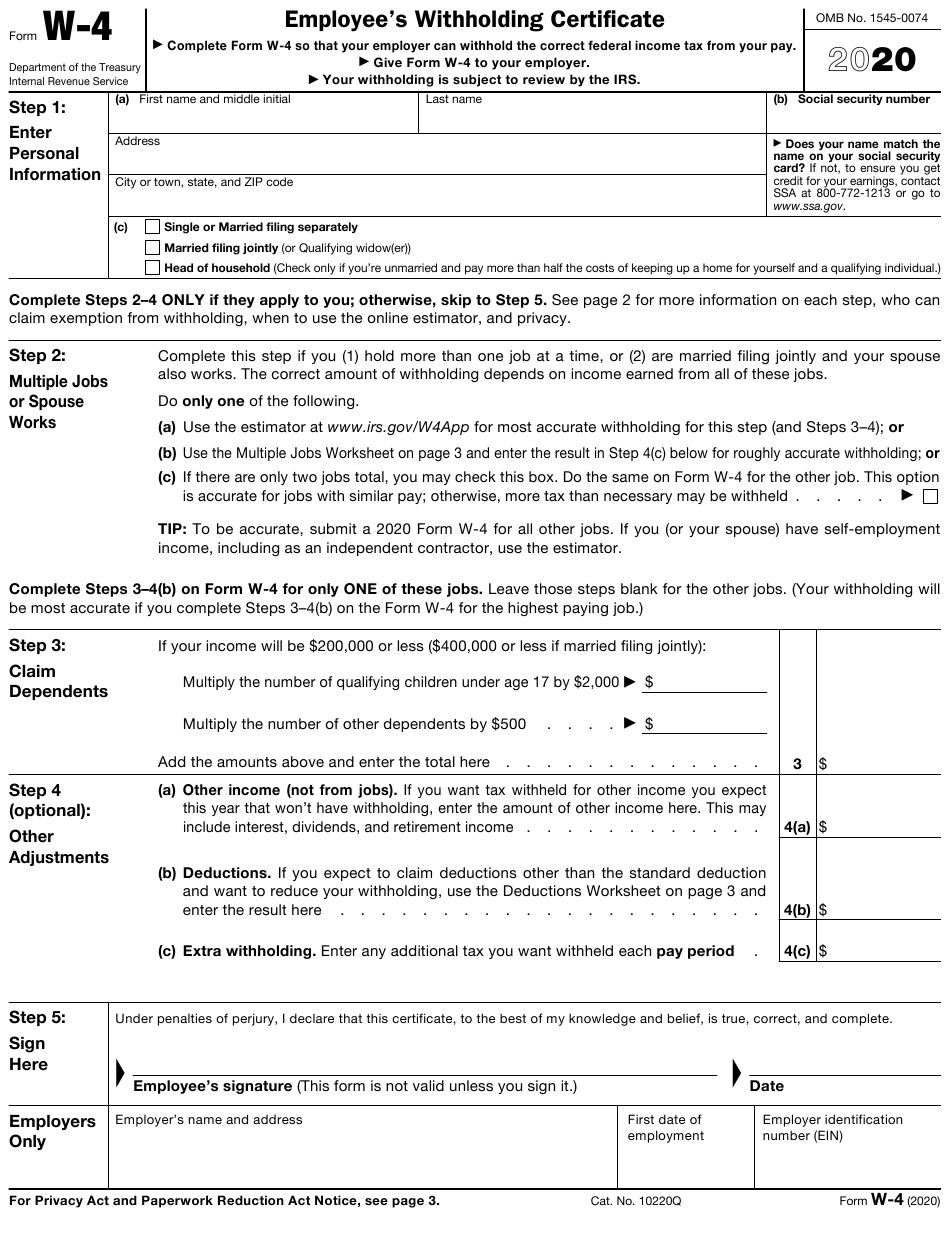

Source: www.scribd.com

Source: www.scribd.com

F 941 PDF Social Security (United States) Withholding Tax, Calculate the estimated payroll taxes due on wages for both employees and employers. If you are already receiving benefits or if you want to change or stop your.

Source: www.youtube.com

Source: www.youtube.com

W4V Voluntary Tax Withholding form Social Security YouTube, The social security limit is $168,600 for 2024, meaning any income you make over $168,600 will not be subject to social security tax. The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, Social security tax withholding for 2024, the social security tax wage base for employees will increase to $168,600. We call this annual limit the contribution and benefit base.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Social Security Cost Of Living Adjustments 2023, Calculate the estimated payroll taxes due on wages for both employees and employers. If you are already receiving benefits or if you want to change or stop your.

Source: www.vrogue.co

Source: www.vrogue.co

Irs Form W 4v Printable Irs Form W 4v Printable Irs F vrogue.co, You can ask us to withhold federal taxes from your social security benefit payment when you first apply. We call this annual limit the contribution and benefit base.

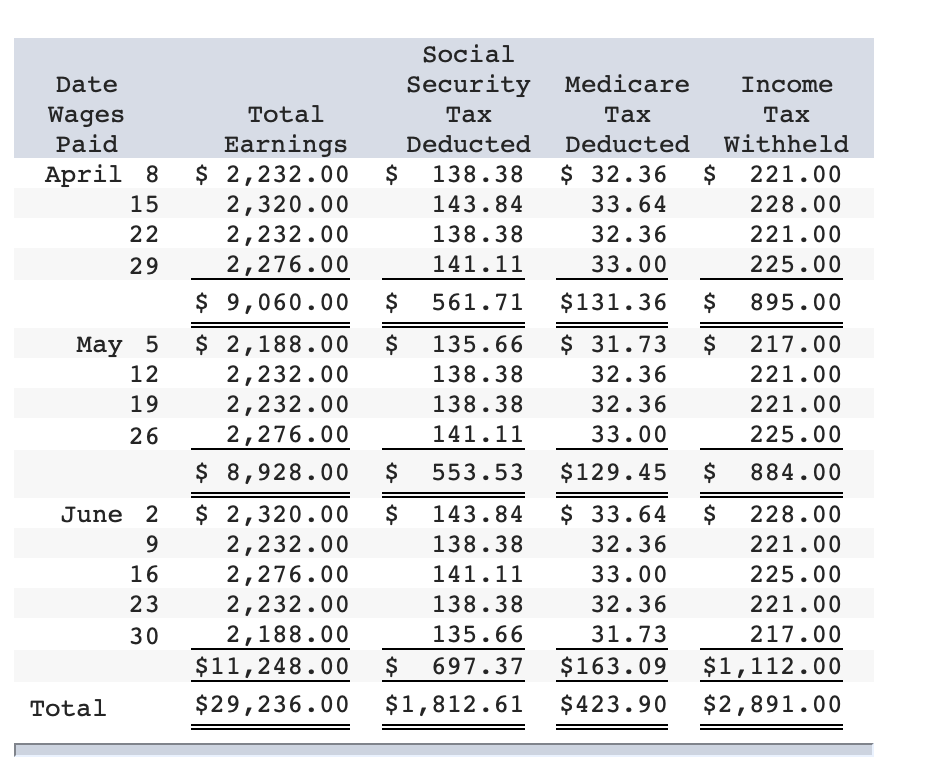

Source: www.chegg.com

Source: www.chegg.com

Solved Help me solve this please? I want to see what you, The social security wage base will rise in 2024 to $168,600, a 5.2% increase from its 2023 wage base of. The 2024 limit is $168,600, up from $160,200 in 2023.

You File A Federal Tax Return As An Individual And Your Combined Income Is Between $25,000 And $34,000.

Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time.

This Amount Is Also Commonly Referred To As The Taxable Maximum.

We call this annual limit the contribution and benefit base.

Posted in 2024